Watten House 36 Shelford Rd, Singapore 288429 Last updated on 2023 September 20 05:09

| TOP | TBA |

| Tenure | freehold |

| Total Units | 286 |

| Site Area | 220,241 sqft |

| Property Type | Apartment / Condo |

| Developer | UOL and SingLand |

| Development | Proposed Residential Development Comprising Low Rise Residential Towers with clubhouse, swimming pool & communal facilities. |

| Website | watten-house.officialdevelopersite.sg |

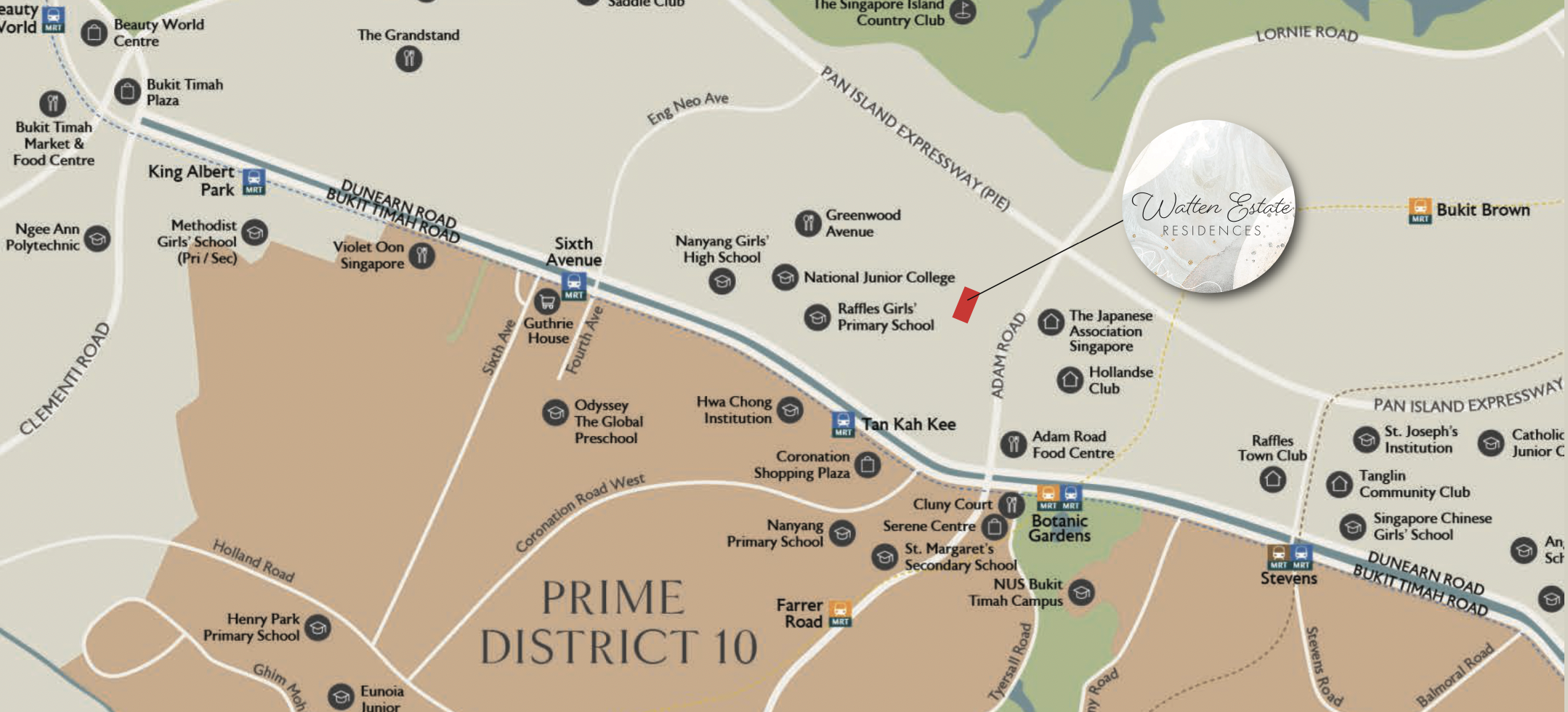

Watten Estate Residences is a residential development located along Shelford Road, District 11 Singapore. This Freehold development has a land area of 220,241 sqft. UOL Group and Singapore Land Group (SingLand) won the tender with a $550 million bid for Warren Estate Condominium last 2021 and have planned to redevelop this into a new condominium with 286 residential units with the minimum average size of 100 sqm.

In the news

Watten Estate Condominium Enbloc Clinched By UOL-SingLand JV for S$550.8m

Business Times – October 28, 2021

UOL Group and Singapore Land Group (SingLand) have clinched a tender to purchase Watten Estate Condominium (WEC).

At the price tag of S$550.8 million, the deal is a 10.2 per cent premium to the S$500 million minimum price announced by the property’s marketing agent JLL in September 2021. WEC’s last collective sale attempt was launched in July 2019 at a reserve price of S$536 million. The property was first put up for en bloc sale in 2007 at the price of S$480 million.

In their respective bourse filings on Thursday (Oct 28), UOL and SingLand disclosed that the tender was awarded to their 80:20 joint venture (JV) between United Venture Investments (UVI) and Singland Residential Development (SRD). UVI and SRD are the wholly-owned subsidiaries of UOL and SingLand, respectively. UOL is a controlling shareholder of SingLand, which was formerly known as UIC (United Industrial Corporation). UVI will pay 80 per cent of the consideration or S$440.6 million for the acquisition based on its proportion of ownership of the JV, with SRD to fund the remainder.

Acquiring WEC is in the ordinary course of business and will enable both groups to replenish their land banks for residential development in Singapore, said both groups in their announcements. SingLand added that the JV parties intend to redevelop the property into a condominium, subject to the necessary approvals from relevant authorities. Both JV parties intend to formalise their terms in connection with the property’s acquisition and redevelopment – and share risks and rewards in proportion to their subsidiaries’ equity stakes in the JV.

Read More